Sneak Peek: The State of the Revaluation

Portland is wrapping up its 2025 reassessment which means property taxes are changing. Property taxes are deeply connected to local policy so the Urbanist Coalition of Portland will be following this process and providing analysis. There is a lot more we want to do but people are in a rush to see the data so this is a sneak peak of some of what is to come.

Disclaimer this data is sourced from the assessor database, which is not guaranteed to be perfect and our data analysis methods are also imperfect. We offer no guarantee that every value in this data is accurate.

Below is a map representing the shift in the taxable value from 2024 to to 2025. Read the details below to get a better understanding of what “Change in Share of Taxable Value” means. There is a big jump from 2024 because we have not done a revaluation since 2021, however a few new properties do get added into the mix between revaluations if there is new construction or renovation and that can impact the share of taxable value. For example, the value increase from new construction in 2024 accounts for about 0.24% of 2025’s taxable value.

Change in Share of Taxable Value (2024-2025)

Base map: © OpenStreetMap contributors © CARTO

Quick Stats

2024 Total Taxable Value = $14,943,084,577

2025 Total Taxable Value = $20,284,439,292

% Change = 35.7% increase

Number of tax Parcels = 25,340

*Edit: The initial summary figures left out some new parcels that only appeared on the 2024 tax rolls resulting in slightly fewer parcels.

Notes

Parcel IDs + Condos: the parcel IDs on this map are shorter than those in the assessor’s database because the last 3 digits of the ID represent the unit (this is typically for condos). For the purposes of this map units are all squashed together into a single parcel and their value is added up. Not every condo will change value at the same rate but unfortunately condos don’t lend themselves well to maps so you will need to download the raw data to get a better sense of different condo valuations.

Missing Areas: The holes in the map you see are tax-exempt properties. Things like parks don’t pay taxes but also hospitals like Maine Med, universities like USM, and government buildings like City Hall.

Taxable Value: some properties have some of their value exempt from taxation. A notable example of this is the homestead exemption. If you qualify for this your property is considered $25,000 less valuable. The valuations considered here are based on taxable value which is the value remaining after these exemptions have been applied.

Raw Data

The data is sourced from the assessor’s database (you can use this to find your parcel’s ID). If you want to explore the data for yourself we’ve created a convenient csv and excel file with all of the valuations back to 2016. The parcel IDs were checked against the most recent tax commitment book and we have data for 24,648 out of 24,815 of those parcels (99.3%). Our total 2024 assessment is 0.6% lower than what is in the commitment book. Note that the 2025 commitment book is based on the 2024 valuations. It was made in 2024 to commit to the budget for 2025. The small differences could be explained by errors or parcels being combined or split so it is reasonable to consider these mostly complete for the purpose of analyzing trends but keep in mind it is not perfect. Also the raw files are quite large so download with caution.

Want to support this work?

If you like the data and analysis and want to see more stuff like it in the future please consider donating a few dollars. We are a small organization of volunteers and even small amounts helps keep data like this hosted!

Property Tax 101

Most local governments in the United States are funded by property taxes. These are charged to property owners as a percentage of the value of their property every year. Most people experience property taxes as a bill that goes up every year but the process is more complicated than that and has huge implications for how a city thrives. In a nutshell the process of charging property taxes works like this:

Assessment: Assessment is how the city decides what each property is worth. The assessment is supposed to reflect what the owner could sell the property for. Cities update all of their assessments every few years, which is called a revaluation. That is what we are going through right now. Assessments can also be triggered for individual properties if there is new construction or significant renovations.

City Budget Process: Every year the city makes a budget of what they are going to spend in the following year.

Mill Rate: The mill rate is the tax rate for the following year. It is determined by dividing the year’s budget by the total value of the taxable property value that has been assessed.

Payment: Each property owner pays their assessed property value multiplied by that year’s mill rate

A good way to think about property taxes is like pie. The size of the pie is the city’s budget. The width of your slice is how big a slice of the city’s property value you own. Together, the city’s budget and the share of property you own determines what your tax bill will be in a given year. Let’s look at a simple example to make the point clearer. Imagine a town with only four properties:

The property values determine how much of the total property each owner owns and that pie slice is used to determine how much of the city’s budget they pay. Changes in property values don’t matter on their own. What matters is how property values change over time. Property values tend to grow over time but let’s say every property in our tiny example town doubles in value but shops aren’t doing too well so they only increase in value by 50% (we are only talking about revaluation here so let’s assume the city’s budget remains the same).

The shop still got more valuable but their tax bill actually went down because all of the other properties got even more valuable. Everyone else’s bills went up slightly to cover the difference. Notice how the properties that paid a higher bill before absorb even more of this new cost. In this example that is the apartment building paying $1.90 of the additional cost.

Change in Share of Taxable Value

This background is important to understand the data and figures here. They do not present the change in property values in absolute terms, but the change in the share of the total they represent. This is the value that ultimately turns into tax bills. If your tax base share is 1% that means you pay 1% of the city’s budget. The change in the share of taxable value represents how much this percentage changes. For example if your share goes from 1% to 1.5% it increases by 50%. This percent change in share is what is reflected in the map above.

Commercial vs Residential

One of the most important dynamics in a tax assessment is the breakdown of value between residential and commercial properties. Residential properties are places people live like single family homes, condos, or apartments and their property taxes are paid by homeowners or indirectly by renters (though rent control complicates this a bit). Commercial properties are things like offices, stores, or warehouses and their property taxes are paid by business owners.

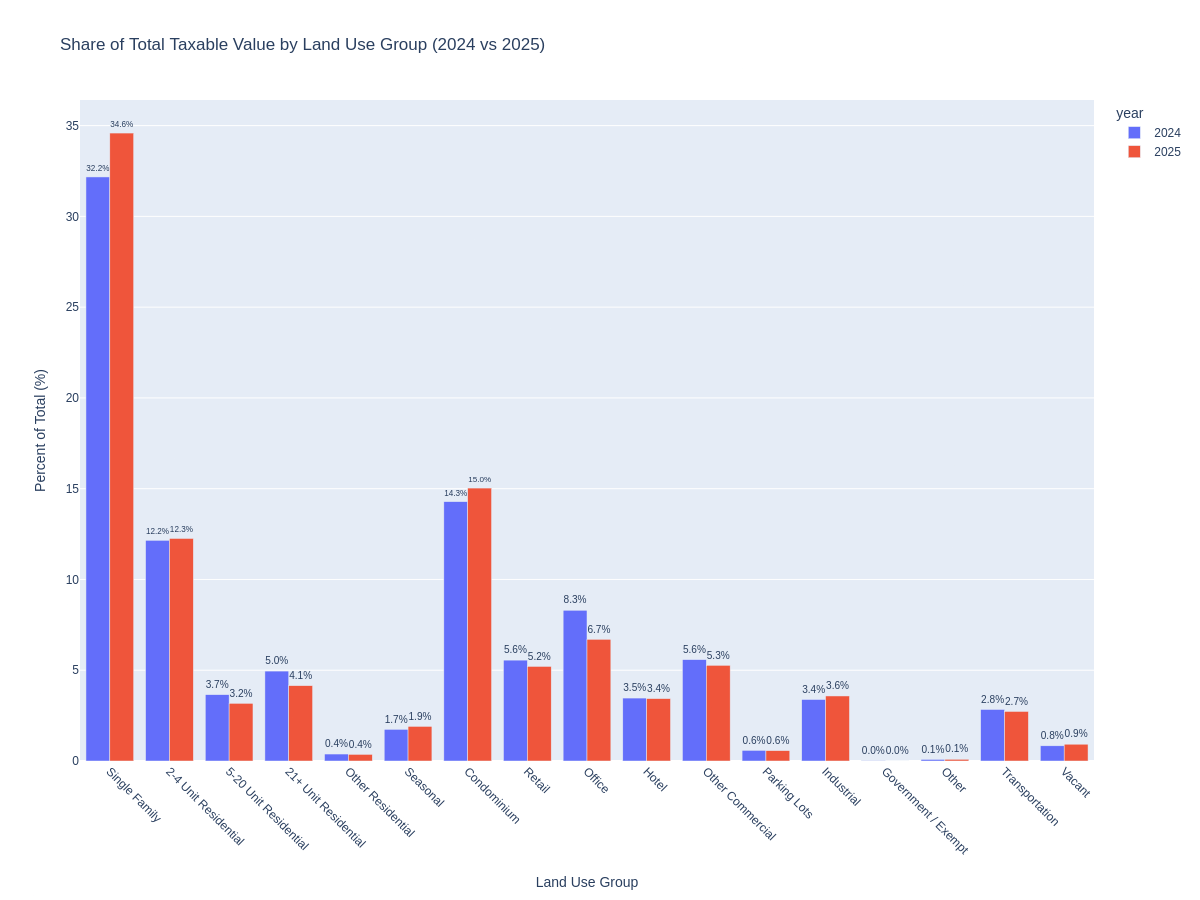

Portland has continued it’s trend of a shift towards residential property values and away from commercial property values. This means that on balance residents will see their share of property taxes go up somewhat. We can split up residential and commercial a bit more to get a better picture of what’s going. Note that the use here refers to how the property is currently being used, not how the land is zoned. The current uses are also the 2025 uses so if land changed use between 2024 and 2025 the use will be as of 2025. This would look like more of the share of tax is shifted from one category to another but it is still the same parcel. Very few properties change use in a given year so this effect is likely quite small.

A few key take aways:

Most of the loss in value share from commercial has has come from offices and retail

Within residential, most of the increase in value share is in single family homes, with some in condos

Larger residential buildings (5+ units) saw their share of taxable value go down

Next Steps

This is just the beginning of our analysis. Eventually we want to create a sort of data dashboard with information like this. A few questions we want to answer with data:

To what extent is new development impacting people’s share of tax valuations?

Are use categories the best lens to analyze valuations through? How do valuations change within a category based on other factors?

Are residential properties getting more expensive or is this just a symptom of a broader decline in value of office and retail buildings?

Why are larger apartment buildings decreasing in value? How does this interact with rent control?

When the city budget is finalized, how will that translate into actual tax bills?

and lots more!